🔥JLP Delta Neutral on Drift

Highest USDC real yield in the market.

Strategy Description

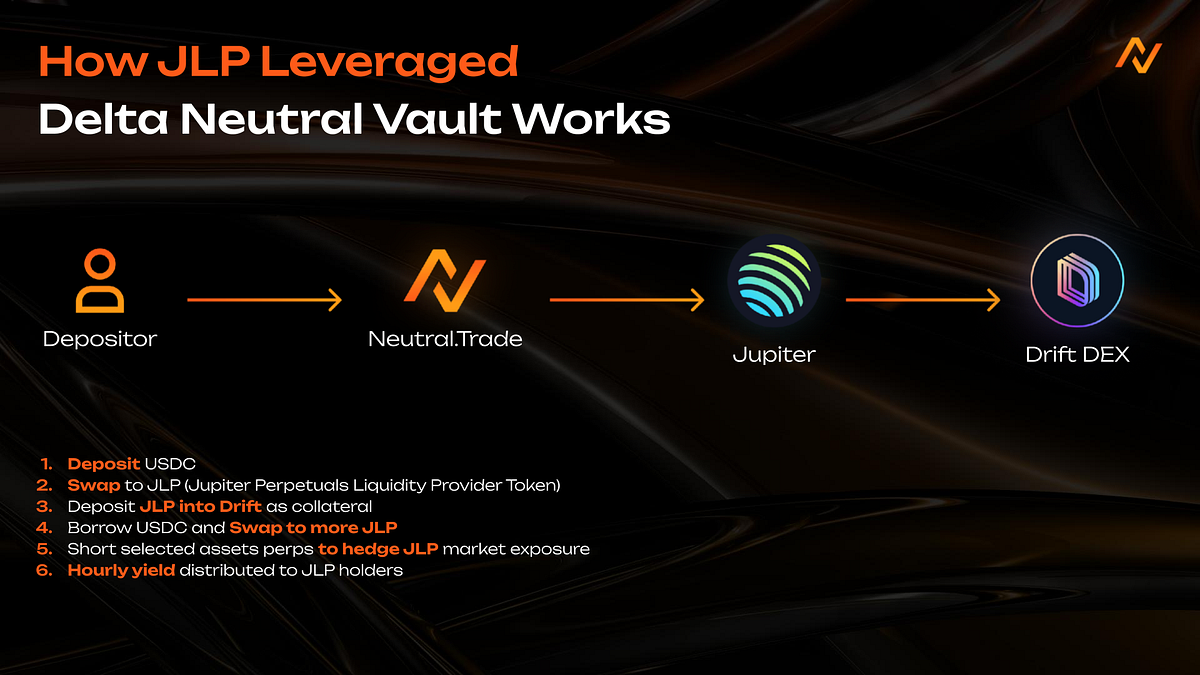

Strategy Design

Yield Sources:

Hedging Targets:

Exposures:

Flow:

Performance

Risks

Last updated