🧺USDC Basis (PerpsBasket) - [Deprecated]

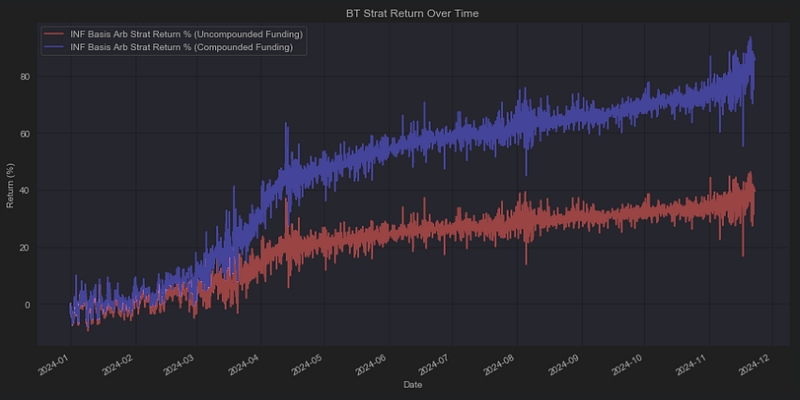

The USDC Basis strategy has achieved incredible success, making it a standout approach for earning yield in both bull and bear markets.

This strategy applies the winning principles across a diverse set of assets for more stability and growth potential.

With this new product, we’re broadening the scope of our proven USDC Basis strategy. By spreading funds across multiple assets, USDC Basis (PerpsBasket) enhances resilience and minimizes risks, delivering consistently high returns.

Why the USDC Basis Strategy

This strategy is a yield-generating powerhouse, delivering consistent returns every hour. Unlike many other strategies, it shines in all market conditions. Whether it’s a bull or bear market, USDC Basis capitalizes on arbitrage opportunities with precision and low risk.

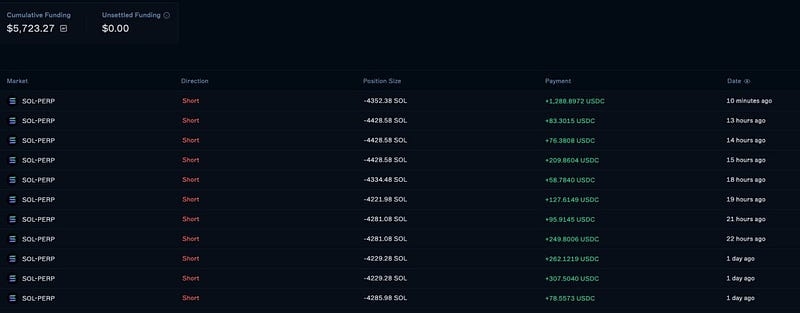

It’s all about exploiting funding rate inefficiencies. For instance, analyzing SOL-PERP funding rates on Drift reveals some impressive stats:

Positive funding rates for 91.5% of the past year

An average annualized funding return of 30%

By arbitraging funding differences between assets, the strategy provides not just consistent yields but also ensures reduced risk through dynamic hedging.

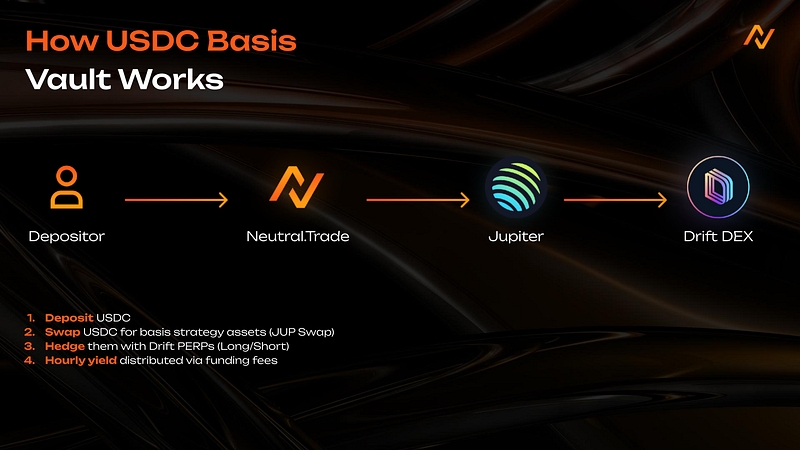

How It Works: A Quick Breakdown

Basis trading involves capturing the price difference between an asset’s spot price and its futures price. In the USDC Basis strategy, this means:

Shorting multiple liquid PERPETUAL FUTURES CONTRACTS on Drift

Buying spot positions dynamically

This combination delivers robust and stable yields through funding fees.

Execution Logic:

Positive funding: Run the basis position.

Negative funding for 5+ days: Reverse the basis position.

The strategy ensures adaptability across market scenarios, leveraging dynamic hedging and diversification. By staying nimble and analyzing funding rates, the strategy reduces risk while maximizing returns.

Fees & Withdrawals

This vault has zero service fees or commission.

Withdrawals are subject to a brief 1-day redemption period.

Check Trades Here (Drift)

Deposit Links:

Neutral Trade Website (Main):

Drift Website (Backup):

USDC Basis (Perps Basket) launch date - 9th December

Last updated