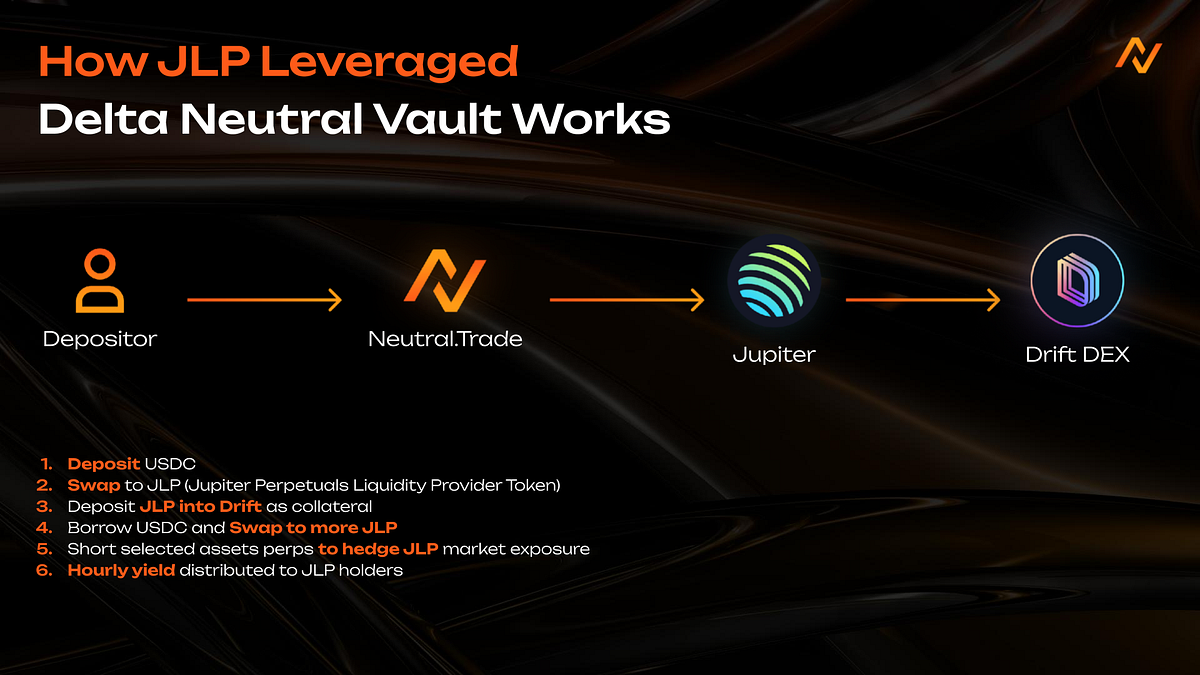

🔥JLP Delta 中性策略 (USDC 本位)

市场上最高的 USDC 实际收益。

策略详解

策略设计

收益来源:

对冲目标:

Exposures风险敞口:

资金流向:

Unexpected error with integration mermaid: Integration is not installed on this space

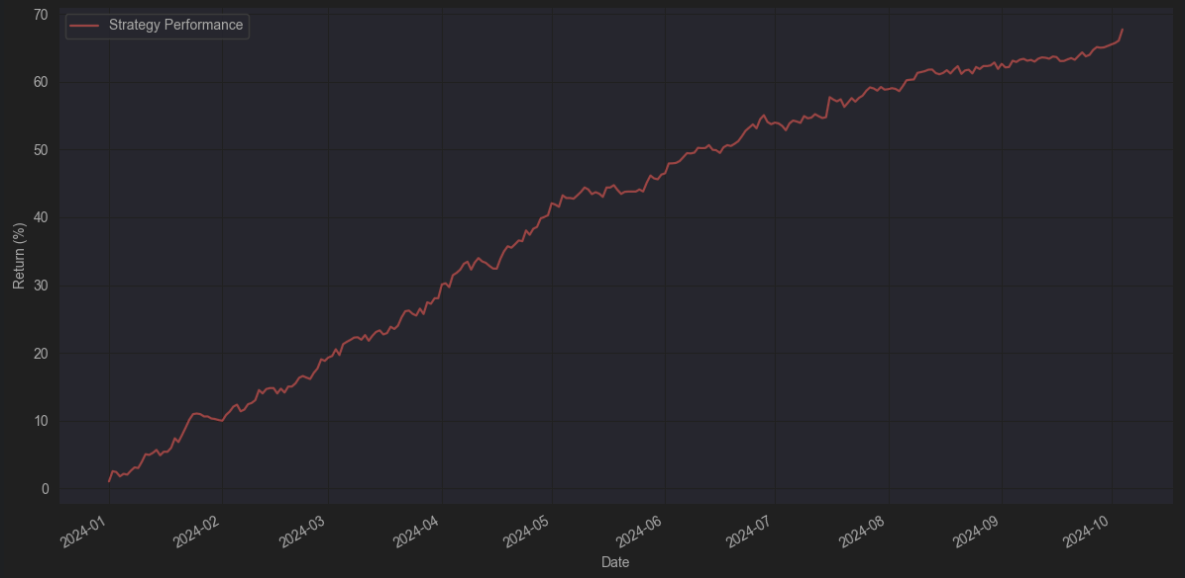

策略表现

风险提示

最后更新于

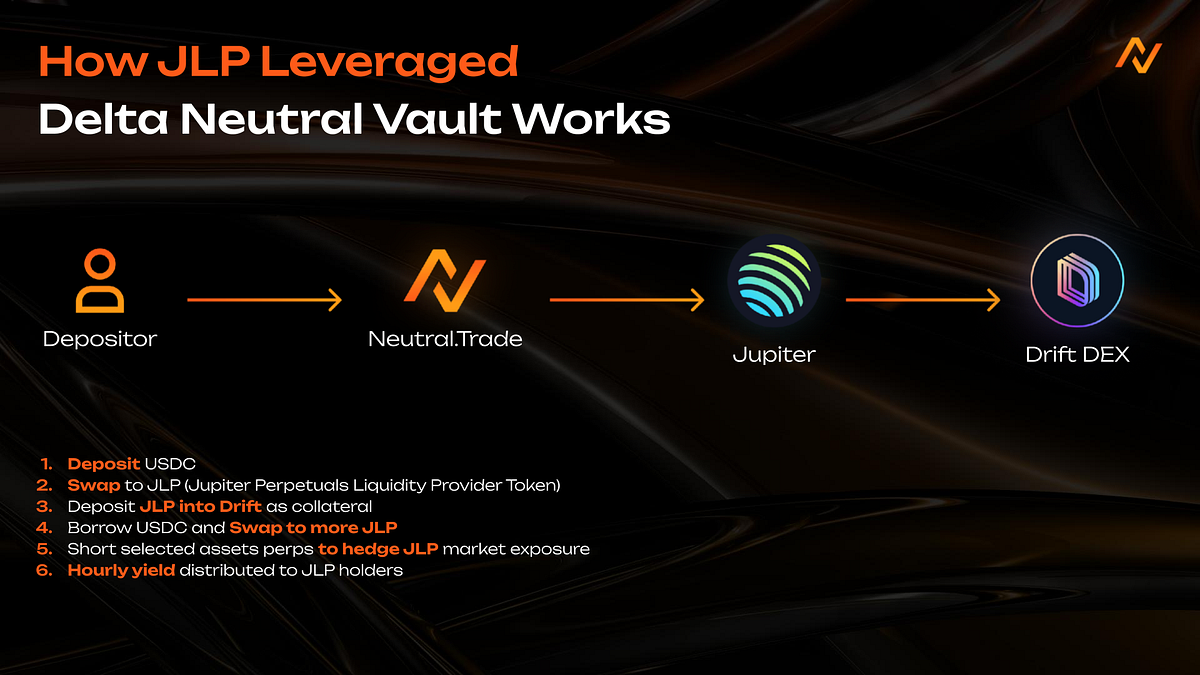

市场上最高的 USDC 实际收益。

Unexpected error with integration mermaid: Integration is not installed on this space

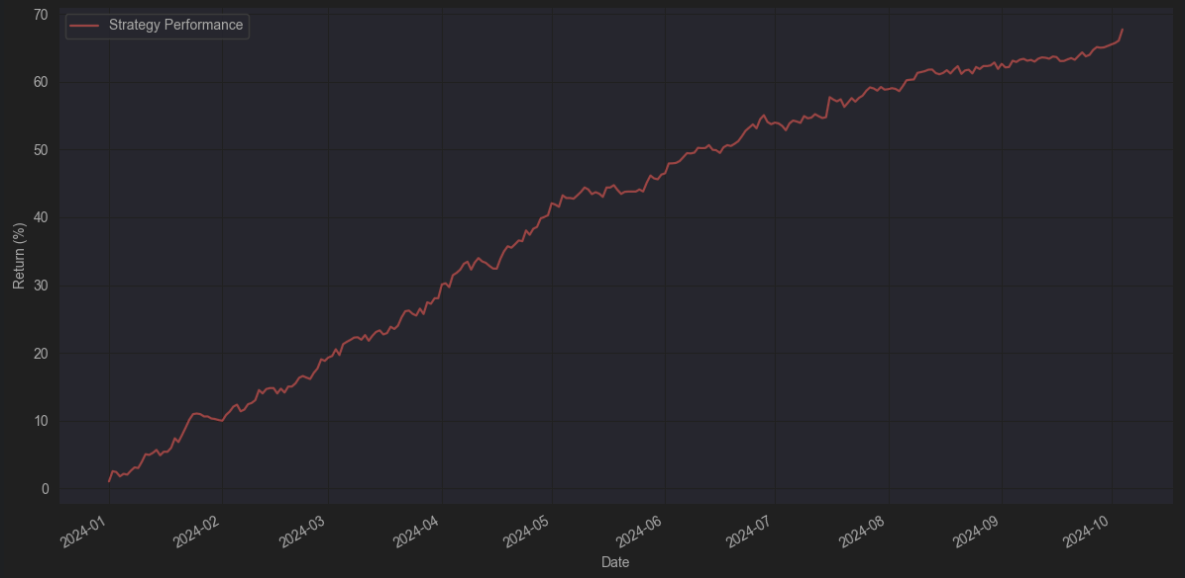

最后更新于